tax loss harvesting canada

The concept behind tax loss harvesting entails that future capital gains can be taxed lower or in part because of capital losses incurred in the present. Contact a Fidelity Advisor.

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

At its most basic tax-loss harvesting.

. How Much Can You Save with Tax-Loss Harvesting. Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income. Contact a Fidelity Advisor.

But in reality its a simple tax saving concept that involves selling a security or. Harvesting a loss involves selling off an asset thats. It only makes sense to harvest losses if you can use them to cancel out capital gains either in the past three years or in the.

You can then use these losses to. What are the risks of tax-loss harvesting. The best way to maximize the value of tax-loss harvesting is to incorporate it into your year-round tax planning.

The best way to pay less tax on your. You are planning to liquidate your. Going back to our example after.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. The bottom line on tax loss harvesting. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered. Tax-loss harvesting is a strategy designed to allow investors to offset gains with losses to minimize the tax impact. Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return.

However in general you can. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. The current tax rules allow you to use capital.

Tax loss harvesting is specifically about avoiding capital gains tax. There are however tax-loss harvesting strategies that allow you to maintain exposure to a particular stock or sector while still realizing a capital loss. Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss.

Canadians are fortunate to have so many tax-sheltered investment options including RRSPs RESPs and TFSAs. Tax loss harvesting sounds like a magical strategy that is only available to the wealthy. The funds are then used to purchase a.

The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket. The strategy offers a. What Is Tax-Loss Harvesting.

Tax-loss selling also known as tax-loss harvesting is a technique for realizing or crystallizing capital losses in your non-registered accounts so they can be used to offset. If you find yourself in one of these scenarios tax-loss harvesting may not be right for you. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

Tax-loss harvesting is the timely selling of securities at a loss in order to offset the amount of capital gains tax due on the sale of other securities at. Make tax-loss harvesting part of your year-round tax and investing strategies. You can then use these losses to offset your taxable.

Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada. Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can.

Tax Loss Selling Using Canadian Listed Etfs To Defer Taxes On Capital Gains 2019 Pwl Capital

Using Exchange Traded Funds In Tax Loss Planning

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo

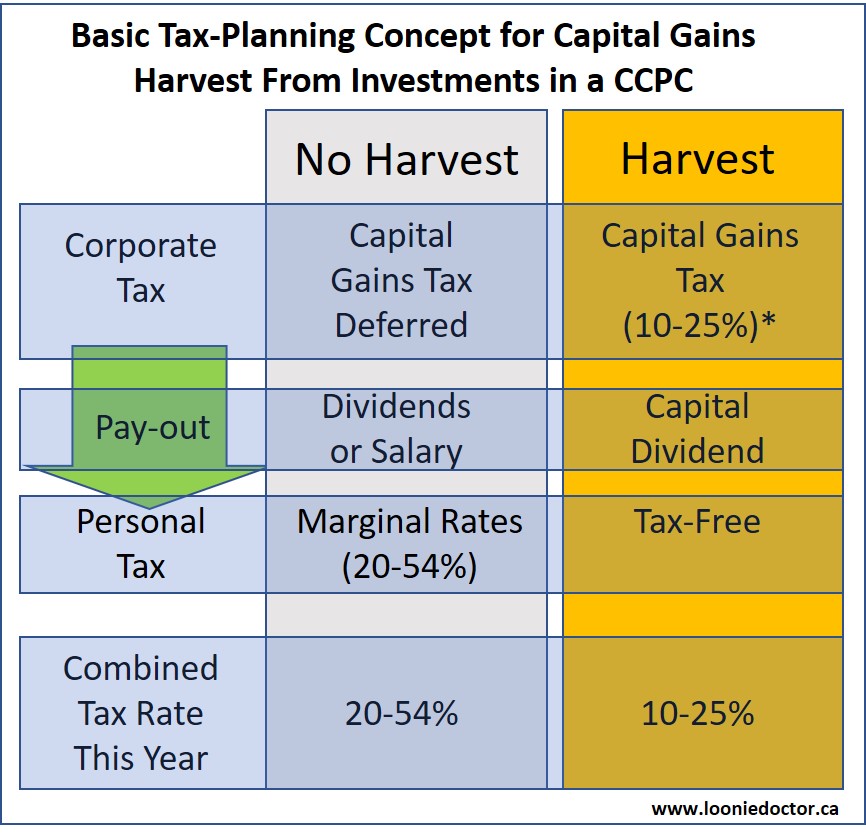

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Turning Losses Into Tax Advantages

Crypto Tax Loss Harvesting Investor S Guide Koinly

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Using Exchange Traded Funds In Tax Loss Planning

How To Use Tax Loss Harvesting To Boost Your Portfolio

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Complete Guide To Canada S Capital Gains Tax Zolo

I Get Free Tax Loss Harvesting Awesome Wait What Is That Wealthsimple

Finding Etf Pairs For Tax Loss Selling Canadian Couch Potato